How does the journey for shoppers of certified pre-owned vehicles differ from the journey for shoppers of new and used cars? Cars.com examined consumer metrics from our own site to find out. Here are our key findings:

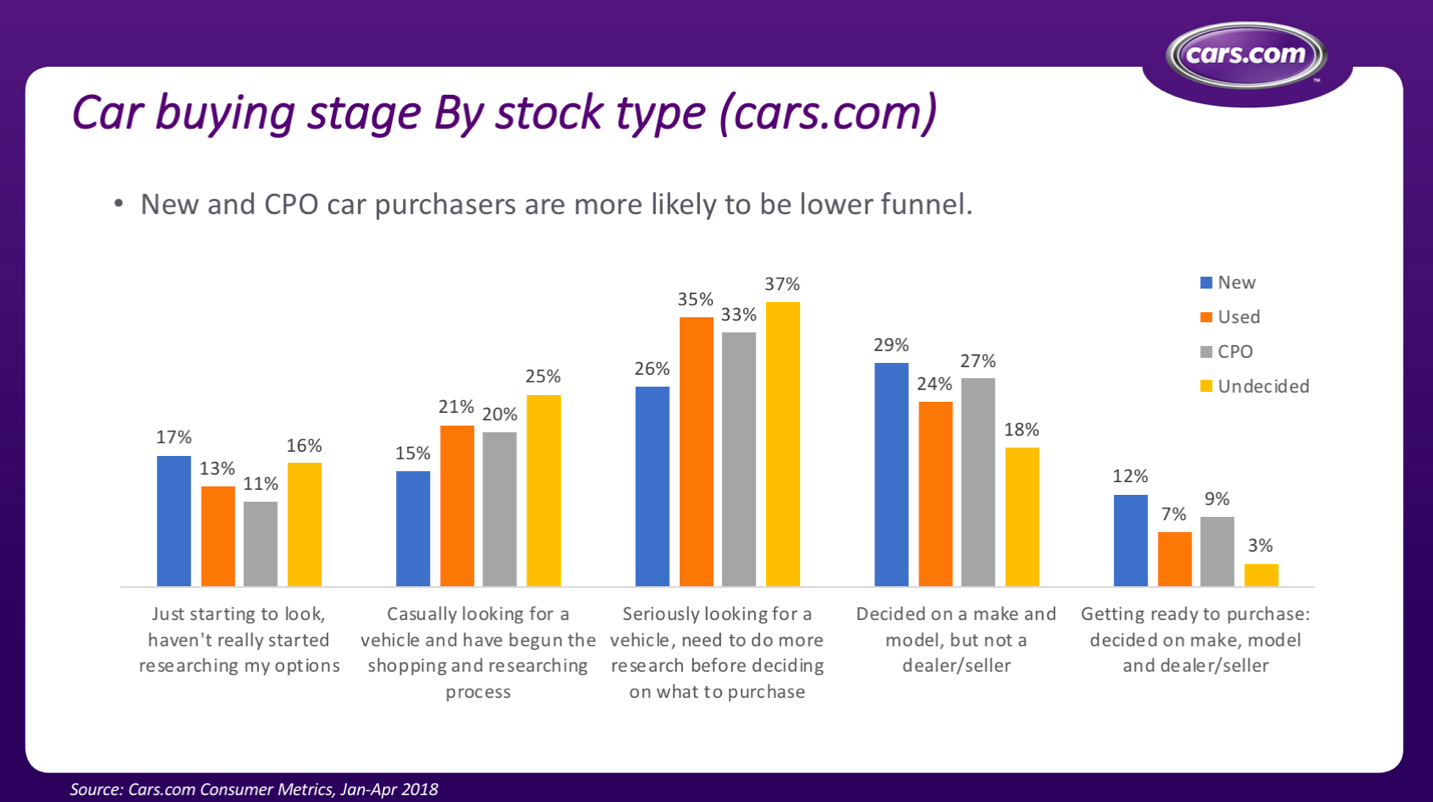

1) CPO shoppers are more likely to be lower funnel buyers compared to used car shoppers.

Thirty-six percent of CPO shoppers told us they had either already decided on a make/model (but not a dealer/seller) or were getting ready to purchase and had decided on a make, model, and dealer/seller.[i] The 36 percent figure compares to 31 percent for used car shoppers and 41 percent for shoppers of new cars.

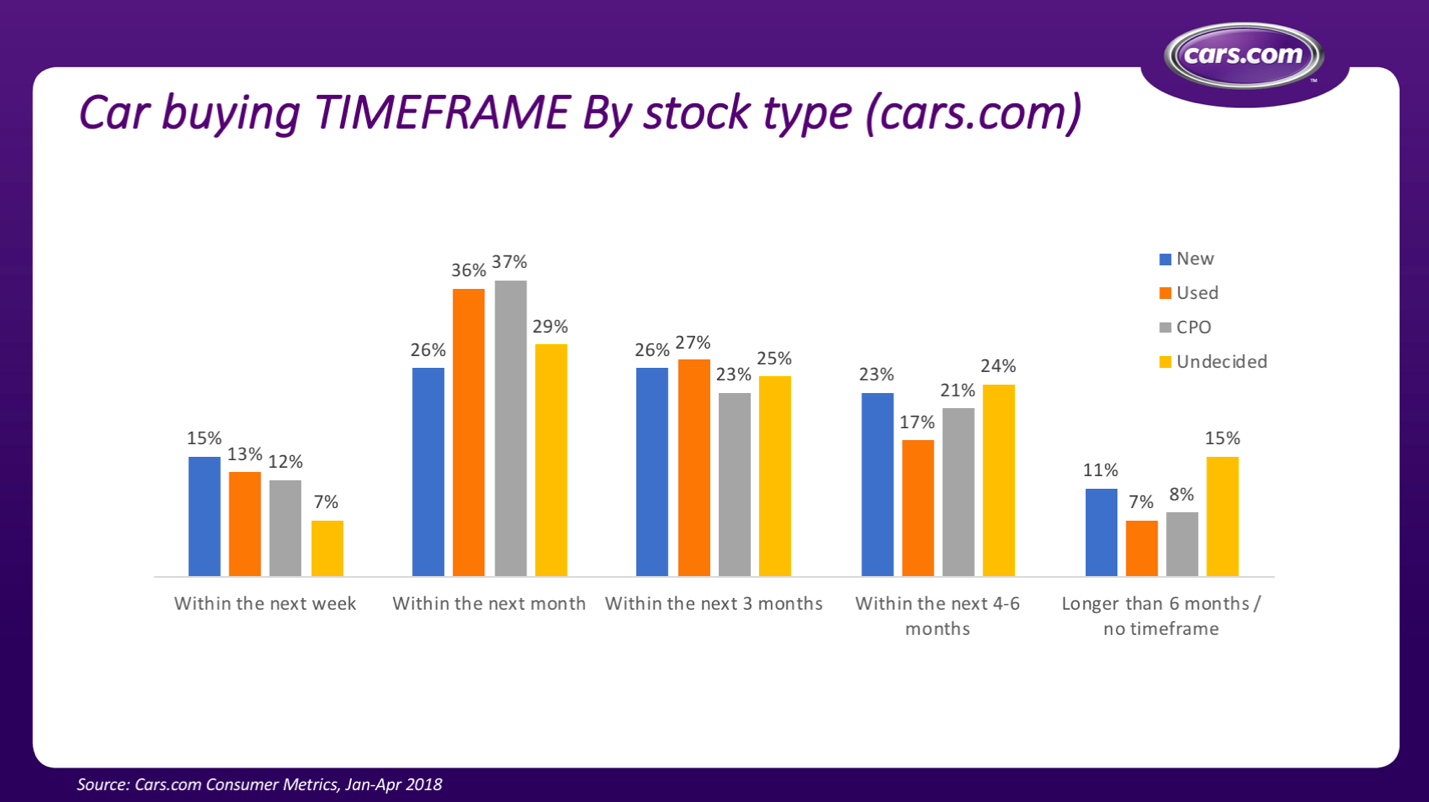

2) CPO shoppers are ready to buy.

About half of CPO shoppers are ready to buy a vehicle either within the next month or the next week, compared to about half of used car shoppers and 41 percent of new car shoppers. Shoppers of both CPOs and used cars are more likely to be motivated to make a purchase.

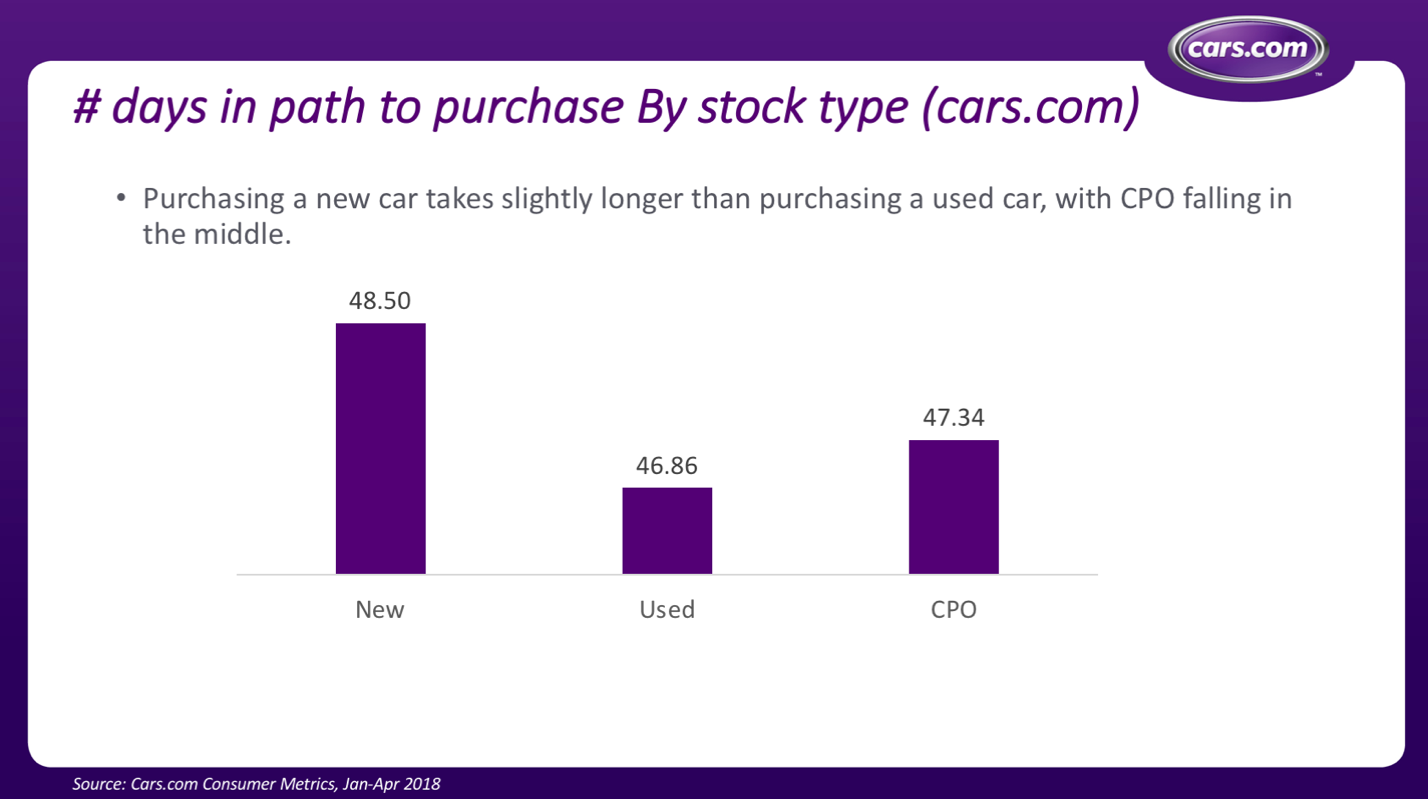

3) CPO shoppers take more time to purchase a vehicle than used car shoppers do.

Purchasing a CPO takes more time than purchasing a used car and less time than purchasing a new car. CPO shoppers take 47.34 days to purchase a car, compared to 46.86 days for shoppers of used cars and 48.5 days for shoppers of new cars. The data suggests that CPO shoppers are somewhat more selective than used car shoppers and require more time to research their purchase.

These findings tell us that when CPO shoppers visit your lot, they’re likely to be actively looking for a specific car they have in mind and are a bit closer to purchase than shoppers of used cars are. Since they take more time to shop than do used car shoppers, they may require more guided selling from your dealership to help them understand the benefits of buying a CPO versus a used car. Be ready to meet them where they are in their journey.

[i] Cars.com Consumer Metrics, January-April 2018.