Automotive shoppers have always set out to find the best deal when looking for a new or used vehicle. Many of us in the industry have tirelessly researched, studied and surveyed every approach consumers take when purchasing a new vehicle so we can target the right consumer with the right message in the right place. In fact, in our own research, finding the best deal for their money is what consumers told us they are ultimately looking for when purchasing a vehicle¹. This isn’t groundbreaking, but how do they get there and, more importantly, how can dealers help them get there?

One thing is clear: Now is the time to start optimizing CPO business. According to Borrell Associates’ latest report, “2016 Auto Outlook, The Thinning of the Media Pack,” a six-year growth in new-vehicle sales is coming to a head having seen an average of 11 percent growth per year since 2010. However, 2016 is looking to have only a 0.5 percent increase in new vehicles sold. It’s forecasted to continue to drop through 2018 and slowly creep back up thereafter².

If new vehicle sales do indeed drop over the next few years, attention needs to be given to CPO programs and service programs at the dealership. This requires more training for dealership employees on the benefits of CPO and more education for consumers so they realize why a CPO vehicle could be the “best deal” for them. Additionally, it will require branding support to OEMs from third parties like Cars.com.

Some dealers aren’t maximizing their CPO offerings for various reasons. “Cost” is the overwhelming frustration expressed when deciding whether or not to certify a used vehicle³. This leads us to believe that education around the ROI of CPO vehicles is an opportunity for growth. Indeed, our research suggests that the estimated average cost spent getting a vehicle reconditioned and certified as CPO is $820³. Other examples holding back vehicle certification included a lack of inventory to certify, space and staff availability at the dealership, OEM requirements for certification and market conditions to name a few³.

There is significant value in building up a CPO program, if done right. But how do we know when a consumer is willing to go down the road of purchasing a CPO vehicle?

How Dreaming and Hunting Result in Buying

In working at Cars.com, we’ve done extensive research into the consumer journey to offer our customers the latest insights and trends to better reach and influence shoppers. Our most recent study, “Differentiating 3 Car Shopper Journeys,” yielded a great deal of insights into the new, used and CPO car shopper journeys.

There are three primary “modes” consumers go through when buying a car, regardless of stock type¹. That journey includes different tipping points to move to purchase and while consumers make shifts by stock type for sure, it’s important to understand the baseline to see the differences. Consumers begin their entry into the car shopping journey in either the Dreaming (Plan), Hunting (Discovery + Vetting) or Buying (Decide) stage. It’s important to note that these various modes are not linear but cyclical. This means the “Buying” mode can lead back to the “Hunting” mode and even “Dreaming” mode based on obstacles or new information the consumer encounters on his or her journey. When in the Dreaming mode, the idea of buying a new car starts to circulate in the consumer’s mind. As a consumer enters the Hunting mode, commitment kicks in and the customer is in preparation, learning, researching, and exploring mode. The final mode of Buying is when the customer narrows down, sees, touches and feels and finds the car that is right for them¹.

This presents an opportunity for dealers by knowing what mode a consumer is in when they walk onto the lot. We know all consumers have the same goal – to get the best deal¹ – but how they succeed varies by stock type.

The best deal for new car shoppers has to do with “the car I want.” These shoppers like to have make and model options, know the type of car and features they want, and know they want a good price.

Used car shoppers seek the best deal for them around the idea of “the best I can get for my money.” This includes considerations around the vehicle being in their price range, the style of car they want, and the most features they can get for the right price.

What about CPO shoppers? Their best deal is “a car I can rely on.” CPO shoppers are looking for reliable ratings when considering make and model, the nicest vehicle they can afford, and the right features.

Growing Your CPO Lane

It’s safe to assume then, that while demand for new vehicles drops, it will rise for CPO and used. Or as Borrell puts it: “a new breed of high-quality, low mileage used cars²” will be front and center. Those who know this can gear up their CPO, used and service sides of the business.

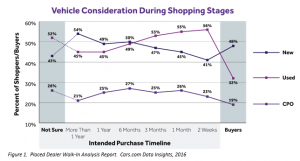

We know from our own research in conjunction with Placed that new vehicles are considered less as shoppers move closer to purchase⁴. In Figure 1, we see that as consumers move closer to a purchase decision new vehicles slide below consideration of used vehicles with consideration of CPO being in slight flux.

Note that the percent of people considering a used vehicle is much higher than the percent of purchasers. In part, this is because our research only includes people that visit a dealership; used buyers from private parties are not represented, but in the moment of decision, shoppers also have a tendency to ‘buy up’ based on our research, which explains why we see a spike in new vehicles bought. How will this change as we move into 2017? That remains to be seen. We also know that consumer mindset suggests indecision on new vs. used throughout the shopping process with CPO considered less as a shopper’s intent moves closer toward a purchase³.

If we know consumers aren’t necessarily set on a specific stock type, there’s room to influence their decision when they visit a dealership regardless of which part of the shopping journey they are in because, again, consumers are searching for their own “best deal¹.”

When it comes to CPO, Cars.com falls in the middle of three major stakeholders with an interconnection of relationships; consumers, franchise dealers and OEMs³. We see our biggest areas of opportunity and influence in educating consumers on CPO and providing support to franchise dealers and OEMs by way of branding support.

Internally, we see value in creating content around the options CPO offers a consumer and the benefits of the franchise experience and a sort of ‘white glove’ treatment it offers a consumer. Many options exist for dealers to educate consumers on CPO by way of advertising content or on the lot information into what a consumer receives from a CPO vehicle. One example could be information booklets of a specific make’s CPO program made available in the vehicle itself made with a comparison to a new or used vehicle. There are many possibilities available to the dealer wishing to grow their CPO sales.

Luxury versus Non-Luxury

But, there is a current worry that CPO sales may be cannibalizing new car sales, a worry that may dissipate in the coming years if forecasts for new car sales do drop². This is understandable, and when you think about the dichotomy of non-luxury versus luxury vehicles, CPO offers another sales option for consumers who may not have considered it at the onset of their search.

Our research indicates that non-luxury sales have the goal of selling used inventory and to convert to CPO intenders secondly³. Luxury sees getting aspirational buyers into new vehicles and use CPO as an entry into a luxury brand³. So, what can be done? Education on CPO programs and branding support can go a long way as CPO helps shoppers by giving them a car that offers value as well as peace of mind. By helping support franchise dealer and OEM CPO programs’ brand building and providing more education on CPO within the industry, we can help shoppers make the right purchase decision.

CPO and the Service Lane

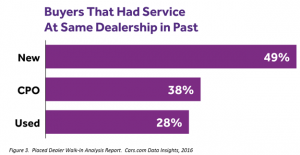

How does this relate to the service lane? We know from our research that 49 percent of new vehicle buyers had prior service interaction at the dealership where they ultimately made their last purchase⁴. Furthermore, 6 out of 10 customers that walk into a dealership are headed for the service department⁴. These service customers will spend money today, and come back in the future as potential sales leads, so loyalty needs to be fostered driving sales retention (Figure 2).

Welcoming back existing customers as a part of the sales process can foster this loyalty. Do we know how many used and CPO vehicles were purchased by a returning customer that had service before their next purchase? Yes, we do. Based on our own surveys and intercepts done March 2015 – February 2016, we know that 4 out of 10 CPO buyers previously had service at the same dealership (Figure 3). Although a CPO and a new vehicle consumer are relatively the same depending on the specific CPO program, CPO intenders are more price sensitive and slightly more interested in luxury brands³, but they may be more willing to gain entry into a luxury brand from a CPO purchase versus an outright new vehicle purchase. This is where your influence can come into play. Selling more CPO and used vehicles could show more returning customers to the service lane as well.

Continuing to support the service lanes at dealerships can foster that customer loyalty that influences future sales leads from existing customers. In the end, we all want to help the customer make the right vehicle choice. It’s a matter of figuring out what influences them, listening to them, and then giving them the best service possible so consumers feel they got their best deal and keep coming back.

Sources

[1] Shopper Differentiation Study, Cars.com Strategic Insights, 2016

[2] 2016 Auto Outlook; The Thinning of the Media Pack, Borrell Associates, 2016

[3] Dealer CPO study, Cars.com Strategic Insights, 2016

[4] Placed Dealer Walk-In Analysis Report, Cars.com Data Insights, 2016