Consumers are interacting with dealerships on mobile. It doesn’t matter if it’s via an app or a mobile browser, consumers are finding dealers where and when they want to find them. That’s important for many reasons. As a dealer, it means that there has to be a constant online presence where inventory is properly merchandised, dealer information and contact information are readily available and consistent across platforms, and proper dealer branding is maintained. That’s a difficult task with employee turnover and inventory turn (the good part). But, many dealers do well with these efforts and those that do understand mobile are the most successful today.

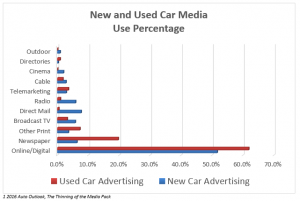

This is evidenced in how dealers are currently spending their ad dollars in 2016. The below data comes from the 2016 Auto Outlook: Thinning of the Media Pack study by Borrell Associates¹. It’s no surprise that digital is taking the majority of ad dollars away from traditional media sources. It makes sense – consumers are on mobile, place dollars in digital.

So, let’s take a look at what we know about using mobile before showing up to the lot, and why it’s so important. Consumers will show up on the lot when they want and with varying degrees of information at their fingertips. Dealers didn’t necessarily know how consumers heard about their dealership or what level of research they performed before showing up unless they physically asked them. But now, dealers have access to this information without needing to ask.

A while back, we launched our Lot Insights report that shows the number of visitors on and around dealer lots who accessed Cars.com from their mobile devices. This was revolutionary at the time by showing the value of being online and what is happening on a dealer’s lot. This also led to understanding consumer behavior on the lot and what behaviors mobile consumers exhibited prior to showing up – valuable information. That’s what we are getting into here.

Auto shoppers want real-time information. We know from our own research that 63 percent of auto shoppers were still researching dealerships after showing up onto a dealer’s lot, and more than half of those visited additional dealerships based on what they found via their mobile devices². These are significant nuggets of information.

One can infer from this that based on auto shoppers’ online research, they found something about a dealership that brought them to the lot, but they want to make sure they are getting the best dealer for them and will continue to shop options while on the lot. The way they compare options and the behaviors they exhibit are what differs across their preferred method of engaging with mobile.

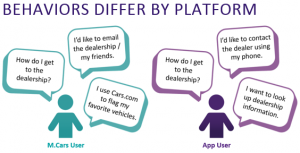

Users of Cars.com’s responsive site differ from users of the iPhone App and those differ from the Android app. That is to say, users of these mobile methods definitely engage with dealerships via mobile, but what our research has found is that they interact with different parts of dealers’ information differently².

For instance, the top two pages accessed by mobile auto shoppers are the Used SRP and VDP. After this, we see New SRP being access by iPhone app users, and VDP photos for used inventory being accessed by Mobile Browser and Android app users. The activities performed the most frequently on Cars.com mobile platforms include the homepage, used inventory, new inventory, and our calculator as a whole².

When consumers show up on the lot, however, it’s not immediately clear how they engaged with a dealership beforehand, so we’ve broken down the most predictive behaviors of mobile auto shoppers. We know that most shoppers are looking up inventory and dealership information. Mobile browser users engage with the calculator for quick payment calculations on the lot. And, app users interact with favorites, comparing cars they previously saw online to vehicles they are seeing in real-time, a big bonus of mobile².

Furthermore, based on our research, we found that a significant portion of those mobile consumers that send an email lead or a phone lead showed up to the dealer’s lot within 30 days (indeed for all lead and contact types). That’s significant. But, these types of leads aren’t the only way consumers interact with dealerships. A large swath of mobile auto shoppers were texting a dealer, reviewing dealer information, reviewing a CarFax, looking at special offers, saving vehicles to favorites, and looking at dealer reviews². All of these are in the top 10 predictive activities that consumers perform on Cars.com before showing up to a dealer’s lot. The biggest takeaways we found, though, were that auto shoppers are accessing driving directions, the dealer map, and reviewing CPO inventory predominantly before showing up on the lot. These best distinguished auto shoppers who are intending to visit a dealership from causal browsers on Cars.com.

Knowing that behaviors by platform differ for consumers is helpful when you consider how to influence them to make a purchase. Looking at what lead and contact types were performed the most – like driving directions or a dealer map – outside of the classic email and phone leads is another great indicator of consumers showing up on the lot and engaging with dealers online. It’s also another way to gauge success and reaching an audience by reviewing how consumers choose to engage with a dealership. Getting them on the lot is the first part. The rest is up to the dealer.

[1] 2016 Auto Outlook, The Thinning of the Media Pack, Borrell Associates 2016

[2] Behavioral Analytics on Mobile, Cars.com, Q3 2016