For auto dealerships, change does not hit in waves — it’s an everyday reality that can help or harm you depending on your adaptability. In coming days on the Grow with Cars blog, we are going to discuss some of the catalysts of ongoing change. Today let’s look at one of the most talked about change catalysts: ride sharing as a business model.

For auto dealerships, change does not hit in waves — it’s an everyday reality that can help or harm you depending on your adaptability. In coming days on the Grow with Cars blog, we are going to discuss some of the catalysts of ongoing change. Today let’s look at one of the most talked about change catalysts: ride sharing as a business model.

Is Ride Sharing a Threat?

Uber and Lyft provide nearly 7 million rides a day[i]. The rise of these and other ride sharing services has raised a lot of questions about car ownership. Will people become so accustomed to ride sharing that they won’t bother buying cars anymore? Should dealerships be worried? Cars.com decided to find out. We surveyed consumers who use ride sharing services regularly. We found that ride sharing creates both a threat and an opportunity for dealerships, but not in the way you might think:

- Ride sharing is not a threat to car ownership – in fact, a strong majority of ride sharers would not give up their cars.[ii]

- But ride sharing is changing consumers’ expectations of dealerships. Generation ride share demands more convenience, transparency, and personalization.

Only those dealerships that adapt to the needs of generation ride share will flourish.

Ride Sharing Will Not Hurt Car Ownership

In June 2018, we sent an online survey via a third party to gather insights on car shopping preferences among consumers. Their use of ride sharing ranged from not using ride sharing services at all to heavy users (multiple trips per week and even daily usage). We found that:

- 79 percent of people who use ride-sharing services would not get rid of their cars if such services became more pervasive.

- 68 percent of heavy ride sharers (multiple trips per week and even daily usage) would not get rid of their cars if such services became more pervasive.

The top three reasons why generation ride share does not want to give up their cars are:

- The ability to leave at any moment

- Concerns about personal safety/security.

- The joy of driving.

The desire to be able to leave at any moment is an obvious vote for convenience. And convenience emerges as one of the major needs of shoppers in the era of ride sharing, as our survey revealed.

Ride Sharing Is Changing Car Shopping

Our survey shows that ride sharing apps are changing consumer expectations for a more convenient, transparent, and personal experience. Ride sharing services have arguably helped spur the rise of an entire on-demand lifestyle, with consumers becoming accustomed to searching for what they want, making a purchase decision, and rating their experience all within one app. Here are our key findings:

Generation Ride Share Wants Convenience

Ride sharers value the frictionless experience they get from online sites. For example, our survey reveals that heavy ride share users are six times more likely than non-ride share users to make online purchases daily. And 52 percent of heavy ride sharers said that they are willing to buy a car online, skipping the dealership, whereas 39 percent of non-ride sharers responded the same way.

These findings suggest a generation of users whose expectations are shaped by a lifestyle free of friction. Ride sharers are accustomed to simply using their app to get a ride when they want it and then not have to fumble around for money to pay for their ride. Everything a ride sharer needs is loaded on to their apps.

Generation Ride Share Expects Transparency

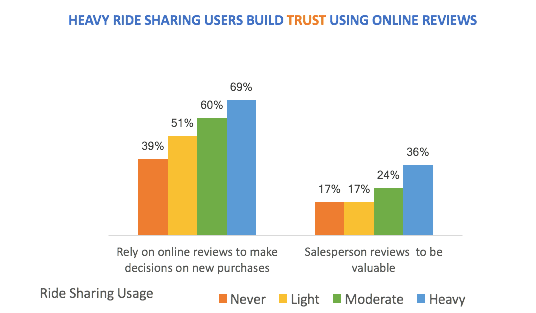

Heavy users of ride-sharing services are more likely to rely on reviews to make purchases, and they are also more likely to find reviews of salespeople helpful. For instance, 69 percent of heavy ride sharers said that they rely on online reviews to make decisions on new purchases versus 39 percent of non-ride sharers. In fact, the more frequently a person uses ride sharing services, the more likely it is that they will rely on reviews to make purchase decisions.

For the ride-sharing generation, transparency is a requirement, not a nice-to-have. Ride sharers are accustomed to reviewing complete details about the driver they’re about to ride with, the car they’re riding in, how much the ride will cost, and the kind of experience they will receive based on customer ratings.

Generation Ride Share Want a More Personalized Experience

The ride-sharing generation rewards a personalized experience based on their lifestyles and purchasing behavior. For instance, our survey reveals that 67 percent of heavy ride sharers purchase products when sites like Amazon recommend products based on the shopper’s past purchases and browsing behavior. By contrast, 21 percent of non-ride sharers do.

What Dealerships Should Do

Dealerships have a number of options to respond to the needs of generation ride share. They include:

- Convenience: Remove friction from the digital-to-offline experience. Take advantage of tools such as price badging that make it easier for shoppers to get real-time information on which cars are more likely to sell than others. Embrace ways to remove the hassle of car shopping, such as digitizing the finance paperwork.

- Transparency: Manage ratings and reviews like an asset year-round, making it easy for your customers to rate your dealership and your salespeople. Participate in a reviews process by encourage customers to review you and responding to reviews.

- Personalization: Apply technologies such as machine learning to make more personalized recommendations based on customers’ likes and dislikes. And use tools that allow shoppers to not only review salespeople but choose them before they visit the lot, just like ride sharers can select their own drivers.

Ride sharing will continue to diversify and shape consumers’ expectations across many industries. Gartner sees the rise of a “new mobility” market that encompasses ride hailing, ride sharing, bike sharing, and peer-to-peer car rentals. Dealerships that sense and respond to the ever-evolving, on-demand world will win.

[i] Endgadget, “Lyft reaches one million rides per day but is still behind Uber,” July 5, 2017.

[ii] Cars.com consumer survey, June 2018.