Join Our Dealer Panel

Earn rewards for providing your valuable feedback on our products and services.

Automotive advertisers will spend nearly $20 billion on digital advertising this year with one goal: trying to reach in-market car shoppers. But despite all of the promises of big data sources and precision targeting, reaching in-market audiences has become increasingly difficult for most advertising providers and most importantly: wasteful.

With new privacy policies changing the digital targeting landscape and inventory shortages making the need for efficient ad spend more important than ever, we’re here to help by uncovering the pitfalls of paying for “in-market audiences” and break down how to find and leverage first-party data to transform your ROI.

The term “in-market” is pervasive in automotive marketing. Nearly every vendor and advertising outlet claim to help you reach an in-market audience, but not all in-market audiences are equal. You have to do your homework to understand what you’re really buying, especially when working with third-party data providers.

Car shoppers are a highly coveted (and valuable) audience, so it’s no surprise many publishers and ad networks overstate the market size. Considering the majority of consumers only buy a car once every seven years, you should be skeptical of claims that outsize a reasonable addressable market. Take for example these new-car shopper audience claims from major providers:

| New-Car Audience Segment Claims | |

|---|---|

| 67 Million | A large credit agency’s U.S. new-car shopper segment |

| 100 Million | A large third-party provider offering branded segments available in their marketplace |

| 136 Million | A third-party provider offering a segment based on vehicle registration data |

If you believe the claims of these providers, as much as 60% of the US is in the market for a new car. The math just doesn’t add up. Assuming about 17 million new cars1 are sold each year in the U.S., and most shoppers are in the market for approximately 90 days, we estimate there are roughly 4.25 million new-car shoppers at any given moment. Be careful not to pay a premium for segments that are really no different than a broadcast audience.

1 Automotive News, January, 2020

For years, media plans were built around demographics. And while understanding your target market certainly plays a role in shaping your marketing strategy, targeting based on demographics alone is not in-market advertising. For example, luxury dealers may want to target wealthy men in their fifties, but do you really want to spend money on them at a Tier 3 level if they are not ready to buy a car?

| Targeting | |

|---|---|

First-Party Audience |  Demographic Based Lookalikes |

Unfortunately, many new digital targeting options are not much better than demographic targeting. Frequently referred to as “lookalike” audiences, segments are built by modeling either your first-party data or third-party data to identify audiences that have similar characteristics to your buyers or to in-market shoppers. While lookalikes can increase the scale of your campaigns, they all too often miss the most important signal: intent. After all, just because two consumers are of a similar age, background, and have similar interests, it is hardly an indicator that both need a new car right now.

While many data claims are frustratingly vague, others are downright false. For example, we often hear of companies claiming to sell Cars.com audience data, which is impossible. We know because pure Cars.com data is only available from, well, us.

Third-parties falsely claiming to offer Cars.com shoppers frequently create audience segments through survey data in which a consumer claims to have visited Cars.com in the past. That data is then scaled with lookalike audiences and sold as “millions of in-market shoppers”, with no basis that any one of those consumers intends to buy a car. In our analysis of these segments, we found less than 100,000 users who overlapped with our first-party data. Buying misrepresented audiences can lead to significant waste targeting consumers who have no intention of buying a vehicle soon.

Watch the whole story about how competitor “in-market” audiences

don’t look anything like the real thing.

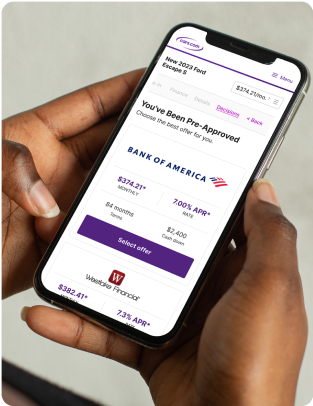

The only way to know you’re spending every penny on actual car shoppers is by using pure audiences. At Cars.com, we take our definition of “in-market audience” very seriously. No junk, no inflation, no lookalike guesses. Our in-market audience is 100% pure, and we know that because it’s only made up of people who were recently on Cars.com actively looking for their next vehicle. Pretty simple.

In this climate we need to make the most of every dollar, so now is the time to ask the tough questions and find out if you are really reaching in-market shoppers with your audience data. Here are some great questions to uncover how your targeting works (along with some winning stats from the home team). Credible partners will be happy to peel back the curtain and share insights to help you understand their audience data.

| Evaluating In-Market Audiences | ||

|---|---|---|

| Questions | Why It Matters | Cars.com’s Answer |

| Where is the data coming from? | While many platforms claim to help you reach car shoppers, it’s important to understand if these segments are simply modeled off of lookalike shopping behavior or from true intenders. | The Cars.com audience is sourced 100% from visits to Cars.com 25.4 MILLION average monthly visitors2 |

| How unique is the audience? | When shoppers can’t find the information they need to make an informed decision, they need to visit multiple sites. Are you paying for the same shopper across multiple platforms? | 66% of Cars.com visitors are unduplicated across other third-party automotive sites.3 |

| When was the data sourced? | Understand the timeframe for in-market activity. Are you reaching shoppers who have shown signals of intent in the last 30 – 90 days, or are you being sold data from consumers who may have already moved beyond the path to purchase? | 49% of Cars.com shoppers plan to purchase within the next month.4 |

| Is the audience open to influence? | In-market doesn’t always mean actively shopping. Will you reach a truly undecided audience that is actively in the process of making decisions and building their consideration set? | 92% plan to purchase or lease are undecided on what dealer they will purchase from.6 |

| Can you reach shoppers across screens? | Today’s shoppers are mobile. Are you able to reach shoppers across platforms and devices? | 75% of Cars.com visits are on a mobile device.7 |

| Is the audience being purchased through a third-party? | It’s important to understand how traffic is generated. Is the publisher driving cheap clickbait visits or are you reaching high-quality visitors? Look for strong organic search and direct traffic as quality indicators. | 70% of Cars.com visits are organic.8 |

| Does the audience convert? | One of the best ways to understand if you are reaching a quality audience is to look at performance metrics. | Shoppers who visited Cars.com 4X more likely to buy than shoppers from any other traffic source.9 |

Once you have the right audience, you need to make the most of it by targeting those in-market shoppers in the right places. From search to social to streaming, Cars.com data is helping dealers reach in-market shoppers everywhere their shoppers are.

As consumers increasingly cut cables in favor of streaming platforms and social networks, gone are the days where you can blast ads on your local TV station and expect it to be effective. But digital video isn’t easy. The proliferation of countless channels and platforms makes it daunting to know how to spend money intelligently. We innovated a solution to take advantage of the sky-rocketing potential of video platforms while addressing the need for efficient audience targeting on them. FUEL: In-Market Video arms dealers with strategic creative campaigns and then reaches active shoppers across the video platforms they watch every day, from Facebook to Hulu.

Dealers using FUEL: IMV are proving that relevancy matters more than reach when it comes to growing their business. When the Walser Automotive Group started using FUEL IMV they not only saw significant lifts in branded search terms — they sold more cars and dominated in market share.

Find out how the Walser group dominated market share

when they tapped into Cars audience data and in-market video.

Given its effectiveness, digital video is predicted to increase at a rate of 19% to $4.8 billion in automotive by 2023.10 With growth, the quality of audiences will vary greatly, and the in-market segments offered by many outlets won’t be much more effective than a general media buy. When you make the move to transfer your local TV budget into digital video, be sure to work with reputable partners that can deliver a trusted, in-market audience.

10 Borrell’s 2018 Outlook, “Automotive Advertising Takes a Sharp Turn”

While there is no doubt social networks offer a great opportunity to stay with car shoppers as they travel the path to purchase, effectively targeting in-market shoppers can be difficult using data from social networks (see Step #1). That’s why we built a solution for dealers to inject our pure local audience data to these massively popular platforms, and then show those shoppers interactive ads with inventory that’s relevant to their search.

When Using  Audience Data On Social Audience Data On Social | ||

|---|---|---|

| 2x Social Traffic To Your Website1 | 1.7x Larger Audience Than Facebook In-Market Segment2 | 2x More Likely To Buy Than Any Other Traffic3 |

Compared to campaigns modeled from a dealership’s first-party website audience, Cars Social drives an 80% unique audience allowing dealers to scale efforts to reach in-market shoppers.11 The combination of clean data and a hyper-focused in-market audience drives greater engagement, higher quality traffic, and a lower cost per VDP.

11 Cars.com Testing Metrics, December 2018

Battlefield Ford taps the power of Cars.com audience data

to accelerate social marketing results.

Search engines remain one of the most effective places to advertise because you can capture shoppers at the moment they’re actively looking for a vehicle or service provider. However, you can make those search campaigns even more effective if you’re able to spend your dollars on the searchers you know are more likely to buy.

Through our team at Dealer Inspire, dealers have the ability to leverage Cars.com audience data in addition to their own audience data to bid on ready-to-buy shoppers in their search campaigns. A testament to the power of high-quality audience data, search clients who tapped into the Cars.com audience saw significant increases in CTR, and decreases in cost per lead.

Audience Dealer Results July 1, 2020 – August 31, 2020 Audience Dealer Results July 1, 2020 – August 31, 2020 | |

|---|---|

| +35%Higher Click-Thru Rate With Cars.com Audience | |

| -60% Lower Cost Per Lead Than Any Google In-Market Search Audience | -49% Lower Cost Per Lead Than All Other Search Audiences Combined * |

And finally, sometimes the simplest way to target your audience is to meet them at the source. Instead of trying to use display ads to convince people to leave whatever they are doing to start shopping for a car, use your limited dollars to target shoppers who are actively in the process of shopping on sites like Cars.com. Because they are actively engaged in the process of deciding what and where to buy, these consumers are more receptive to your message. That’s why display ads on Cars.com consistently outperform other display networks.

| Reach In-Market Shoppers In The Moment | |

|---|---|

| 5% AVG. LEAD RATE CARS.COM DISPLAY* vs. | 0.03% AVG. LEAD RATE DISPLAY NETWORKS* |