A White Paper Written by Google in Collaboration with Cars.com

Auto Marketplaces’ Role in the Auto Shoppers’ Journey

January 2020

Overview and Headline

The journey of an auto shopper is both long and complex. Thousands of touchpoints are used, many of them several times throughout the journey. Auto marketplaces are diffuse; 89% of auto shoppers leverage auto marketplaces at some point in their auto shopping journey, playing an integral role in the auto shopper’s consumer journey.

Additionally, auto marketplaces drive new traffic to OEM and dealership sites (traffic that wasn’t already on your site in the past 30 days). Our study found that almost 2 in 3 consumers who visited the OEM or dealer site and came through an auto marketplace, had not previously visited in the past 30 days.

To note: This analysis only looked at one piece of the customer journey, the inclusion of auto marketplaces on paid search verses not. It did not include any other touchpoints. Auto marketplaces are not the only touchpoint used along a journey, just one of several touchpoints.

Finding 1:

When auto marketplaces invest strategically in paid search, it drives site visitation and upper and lower actions on OEM/Dealership sites.

Our research shows that not only do auto marketplaces drive auto shoppers to visit OEM and dealer sites, but those shoppers are also taking valuable action on the OEM and dealer sites once they get there in both the upper and lower funnel.

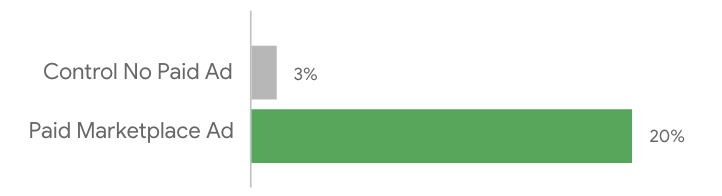

Consumers who clicked on a paid auto marketplace ad were more than four times more likely to visit an OEM or dealer site than those who were not served a paid auto marketplace ad.1

Site Visits

Visit to OEM/Dealer Site

“Shoppers seek out third-party marketplaces in the car shopping journey as trusted and unbiased choice editors who are critical in helping to inform buying decisions,” said Brooke Skinner Ricketts, CMO of Cars.com. “It’s not surprising that in-market shoppers progress from our site to take valuable actions on a dealer or OEM site because we’re helping them identify their next steps with our deep content, extensive listings and impactful shopping tools. Our marketing and product experience is tuned to provide a seamless and relevant shopper experience that enhances the value and deepens the connection with our advertiser customers.”

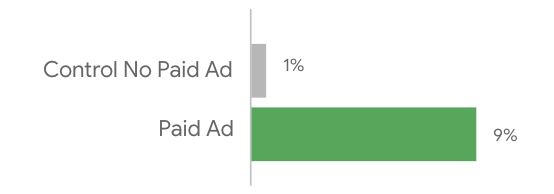

Consumers who clicked on a paid auto marketplace ad were nearly six times more likely than those who were not served a paid auto marketplace ad to take a key upper funnel action (e.g. visit photo gallery) on OEM or dealer site within the same day.2

Upper Funnel

Brochure

Color

Features

Find Match

Future Vehicles

Gallery

Model Landing

Offers

Owners

Specs

Local dealership Site visitation (>1 min in session)

Consumers who clicked on a paid auto marketplace ad were six times more likely than consumers who were not served a paid auto marketplace ad to take a key lower funnel action (e.g. requesting a quote) on an OEM or dealer site within the same day.3

Lower Funnel

BYO (build your own)

Compare

Credit App

Estimator

Financial Info

Locale Dealer

Pricing

RAQ (request a quote)

Search Inventory

Test Drive

Trade-in

Key Takeaway: Understand your customers’ motivations and how you’re valuing them in moments of intent.

Finding 2:

New customers to dealer/OEM sites continue to search on non-branded terms post conversion.

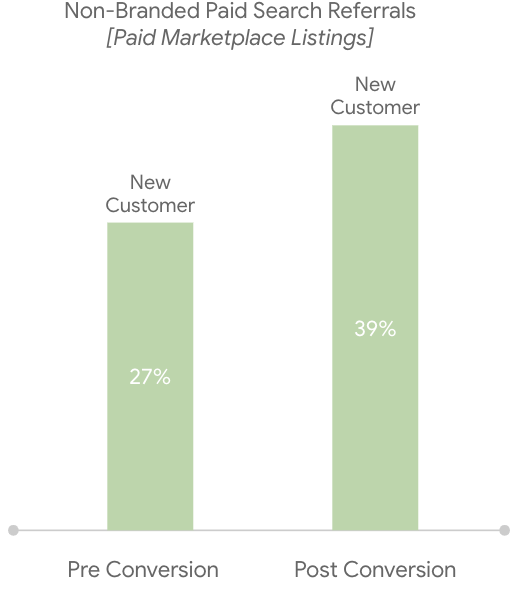

As we know, non-brand search is a key part of the beginning of the auto shopper’s journey, but our research found that non-brand search also plays a key role later in the auto shopper’s journey.

Our research shows that 30 days before the conversion event, 27% of all searches conducted by new customers were non-branded, and 30 days after the conversion event, this number increased to 39%.4

Auto marketplaces allow OEM’s and dealerships to tap into new customers by leveraging non-branded searchers and driving engaged traffic to your site, as the journey is longitudinal in nature and just because they perform an action doesn’t mean they are done researching!

“The value of marketplaces like Cars.com is that they’re actively sought out by auto shoppers as unbiased third parties where shoppers can compare and contrast their options to help inform their final purchase decision,” said Skinner Ricketts. “We know more than 70% of shoppers on Cars.com are undecided about the vehicle make and model that they want to buy, which means they’re open to influence and, in most cases, are exploring multiple brands.”

Key Takeaway: Value each touchpoint along the journey and how they contribute to the overall purchase path.

Finding 3:

Existing auto marketplace customers continue to take action after they submit their first lead form.

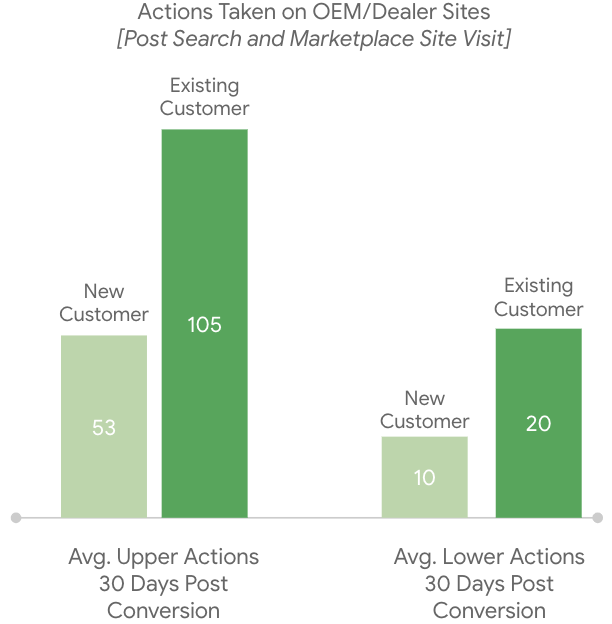

Re-engagement with auto shoppers is more important than ever and the findings of our research highlights that fact. New customers, on average, conduct over 50 upper funnel actions post-conversion, and 10 lower funnel actions post-conversion. Existing customers, on average, are even busier, conducting over 100 upper funnel actions post-conversion and 20 lower funnel actions post-conversion.5

The search intensity of auto shoppers, therefore, continues to increase throughout the journey even after initial conversions take place. New and existing OEM site visitors are more likely to continue exploring, searching, and cross-shopping after their first action on the OEM site. Auto marketplaces redirect them back to your site.

“We’ve known for some time that the car shopping journey isn’t linear,” said Skinner Ricketts. “Based on the consumer site activity we’ve tracked over the past year between Cars.com and Dealer Inspire dealer websites, there’s a strong pattern of shoppers toggling back and forth between third-party marketplace and dealer websites to validate their decisions. Our research shows that these cross-shoppers are four times more likely to result in a vehicle sale, indicating the powerful consultative role that third-party sites play throughout the decision journey. Even post-lead submission, there is indisputable value for both shopper and seller in the combination of first-party and third-party marketing engines to win the final mile of the sale.”

Key Takeaway: Remember that customers aren’t “done” once they submit the lead. Continue to engage them to influence their choice.

Conclusion

Auto marketplaces are an integral part of the auto searcher journey. Paid marketplace search ads and auto marketplace websites drive valuable new referral traffic to OEM and dealership websites that may not have visited otherwise. These searchers are performing critical upper and lower funnel actions on your website.

Appendix

Methodology

- Measure the effectiveness of auto marketplace related, paid search advertising exposure using Comscore’s 2M+ panel.

- Journey measured: 1) Auto Researcher searches on keyword and SERP renders a paid search ad (marketplace has to be there). 2) Researcher clicks on paid marketplace ad and visits the marketplace site. 3) Dealership site or OEM site + action

- Upper funnel actions measured include visiting any of the following pages of an OEM website: Brochure, Color, Features, Find Match, Future Vehicles, Gallery, Model Landing, Offers, Owners Specs

- Lower funnel actions measured include visiting any of the following pages of an OEM website: BYO (build your own), Compare, Credit App, Estimator, Financial Info, Locate Dealer, Pricing, RAQ (request a quote), Search Inventory, Test Drive, TradeIn

Terminology

- Marketplace User: Someone who searches on Google.com, sees an auto marketplace ad and clicks it

- Non-Marketplace User: Someone who searches on Google.com, does not see an auto marketplace ad and therefore it is not a part of their user journey

- New Customers: Upon first KPI on OEM/dealer site, user visits an auto marketplace site on same day prior to OEM visit. They did not visit OEM site within the “lookback window” (30 days) prior to this activity.

- Existing Customers: Upon first KPI on OEM/dealer site, user visits an auto marketplaces site on same day prior to OEM visit. They visited OEM site within the “lookback window” (30 days) prior to this activity.

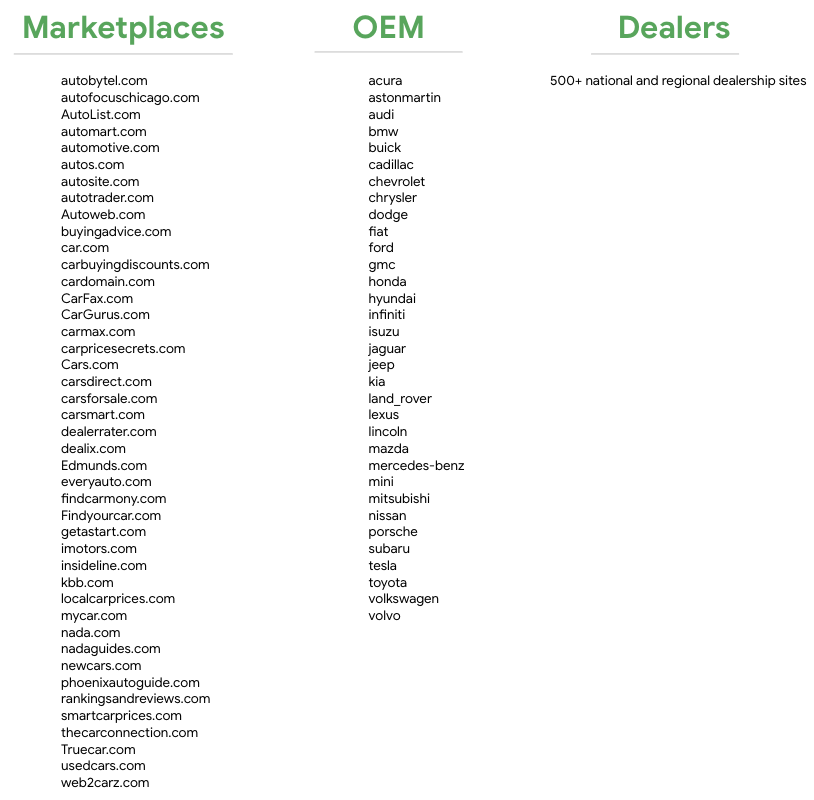

OEMs and Auto Marketplaces Measured

- Google and Comscore Value of Aggregator Ad Study, US, 2019

- Google and Comscore Value of Aggregator Ad Study, US, 2019

- Google and Comscore Value of Aggregator Ad Study, US, 2019

- Google and Comscore Value of Aggregator Ad Study, US, 2019, Note: Converters defined as consumers who visited an aggregator site and later did a conversion event on OEM or dealer site on the same day. Existing customers defined as converters who have visited OEM or dealer site at least once 30 days prior. New customers defined as converters who have not visited OEM or dealer site 30 days prior.

- Google and Comscore Value of Aggregator Ad Study, US, 2019, Note: Converters defined as consumers who visited an aggregator site and later did a conversion event on OEM or dealer site on the same day. Existing customers defined as converters who have visited OEM or dealer site at least once 30 days prior. New customers defined as converters who have not visited OEM or dealer site 30 days prior.